Unlock Audi Used Car Loan Rates: Get Your Dream Ride Now!

Audi Used Car Loan Rates: Everything You Need to Know

Introduction

Greetings, readers! Are you considering purchasing a used Audi car and wondering about the loan rates? Look no further, as this article will provide you with all the information you need regarding Audi used car loan rates. Owning a luxury vehicle like an Audi can be a dream come true for many, and with the right loan, it can become a reality. In this article, we will explore the various aspects of Audi used car loan rates, including what they are, who can avail them, when and where to apply, why they are advantageous, and how you can benefit from them. So buckle up and let’s dive right in!

1 Picture Gallery: Unlock Audi Used Car Loan Rates: Get Your Dream Ride Now!

What Are Audi Used Car Loan Rates?

📌 Audi used car loan rates refer to the interest rates that financial institutions charge individuals who are looking to purchase a pre-owned Audi vehicle through a loan. These rates vary depending on factors such as the borrower’s credit score, loan duration, and the current market conditions. It is crucial to understand these rates to make an informed decision when financing your Audi purchase.

Who Can Avail Audi Used Car Loan Rates?

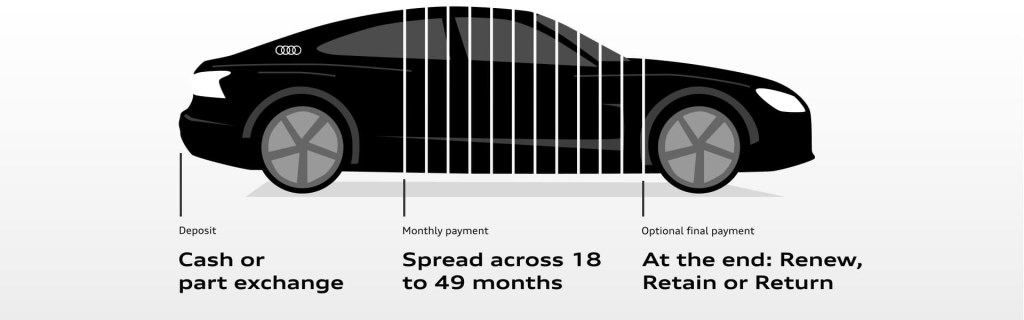

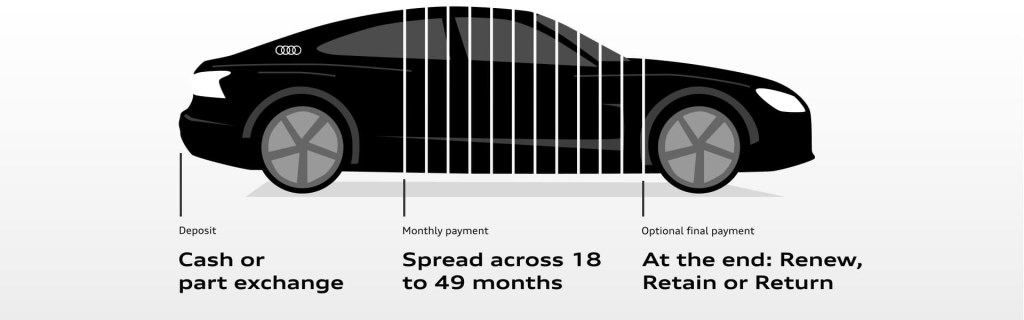

Image Source: audi.co.uk

📌 Audi used car loan rates are available to individuals who meet certain criteria set by financial institutions. Typically, these loans are accessible to individuals with a good credit score, stable income, and a reasonable debt-to-income ratio. However, even if you have a less-than-perfect credit history, there are often options available, albeit at higher interest rates.

When and Where to Apply for Audi Used Car Loan Rates?

📌 You can apply for an Audi used car loan rate at various financial institutions such as banks, credit unions, and online lenders. It is advisable to research and compare the interest rates and terms offered by different lenders before making a decision. Additionally, the ideal time to apply would be when you have a good credit score and stable employment, as this will increase your chances of securing a favorable loan rate.

Why Choose Audi Used Car Loan Rates?

📌 There are several reasons why opting for Audi used car loan rates can be advantageous. Firstly, these rates often offer lower interest rates compared to other types of loans, making them more affordable. Additionally, financing your Audi purchase allows you to spread out the cost over a set period, making it more manageable. Furthermore, if you make regular payments on time, it can help improve your credit score, which can benefit you in the long run.

How to Benefit from Audi Used Car Loan Rates?

📌 To make the most of Audi used car loan rates, it is essential to consider a few key factors. Firstly, determine your budget and understand your financial capabilities to ensure that the monthly repayments are affordable. Secondly, compare loan offers from different lenders to find the most competitive rate. Lastly, read the terms and conditions carefully, including any potential fees or penalties, to avoid any surprises down the road.

Advantages and Disadvantages of Audi Used Car Loan Rates

📌 Pros:

✅ Lower interest rates compared to other loans

✅ Spread out the cost over a set period

✅ Potential to improve credit score

✅ Accessible financing options for individuals with varying credit histories

✅ Ability to own a luxury Audi vehicle at an affordable price

📌 Cons:

🛑 Higher interest rates for individuals with lower credit scores

🛑 Potential for additional fees and penalties

🛑 Risk of depreciation affecting the vehicle’s value

🛑 Limited customization options for used cars

🛑 Possibility of purchasing a vehicle with hidden issues

Frequently Asked Questions (FAQs)

1. Can I get an Audi used car loan with bad credit?

Yes, it is possible to obtain an Audi used car loan with bad credit. However, individuals with a lower credit score may face higher interest rates and stricter approval criteria.

3. What is the average interest rate for Audi used car loans?

The average interest rate for Audi used car loans varies depending on several factors, such as the borrower’s credit score, loan duration, and market conditions. It is advisable to shop around and compare rates from different lenders to find the best deal.

4. Can I refinance my existing Audi used car loan?

Yes, refinancing your existing Audi used car loan is an option. By refinancing, you may be able to secure a lower interest rate or adjust the loan term to better suit your financial situation.

5. What happens if I default on my Audi used car loan?

If you default on your Audi used car loan, the lender may repossess the vehicle to recover their losses. It is crucial to make timely payments to avoid such situations and protect your credit score.

6. Are there any prepayment penalties for Audi used car loans?

Some lenders may charge prepayment penalties for paying off your Audi used car loan earlier than the agreed-upon term. It is crucial to review the loan agreement and discuss any potential penalties with the lender before signing.

Conclusion

In conclusion, Audi used car loan rates provide individuals with the opportunity to own a luxury vehicle at an affordable price. By understanding the various aspects of these loan rates, including their advantages, disadvantages, and how to benefit from them, you can make an informed decision when financing your Audi purchase. Remember to compare offers from different lenders, consider your budget, and read the terms and conditions thoroughly. With the right loan, you’ll be driving off in your dream Audi car in no time!

Final Remarks

📌 It is important to note that the information provided in this article is for informational purposes only and should not be considered as financial advice. Loan rates and terms may vary depending on the lender and individual circumstances. Always consult with a financial professional before making any financial decisions. Happy car shopping!

This post topic: Used Car