Unlock Affordable Car Loans With TransUnion: Drive Your Dream Car Today!

Car Loans That Use TransUnion: A Comprehensive Guide

Greetings, readers! If you’re in the market for a car loan, you’ve come to the right place. In this article, we will delve into the world of car loans that use TransUnion, one of the leading credit reporting agencies. Understanding how these loans work and their benefits can greatly assist you in making an informed decision when it comes to financing your next vehicle. So, let’s get started!

Introduction

Before we dive into the specifics, let’s first understand what car loans that use TransUnion entail. TransUnion is a renowned credit reporting agency that collects and maintains credit information on individuals and businesses. When applying for a car loan, lenders often refer to TransUnion’s credit reports to assess your creditworthiness and determine the terms of your loan.

2 Picture Gallery: Unlock Affordable Car Loans With TransUnion: Drive Your Dream Car Today!

In this article, we will explore various aspects of car loans that use TransUnion, including what they are, who can benefit from them, when to consider applying, where to find these loans, why they are advantageous, and how to apply for them. By the end, you’ll have a comprehensive understanding of these loans and be better equipped to make informed financial decisions.

What Are Car Loans That Use TransUnion?

Car loans that use TransUnion are financing options offered by lenders who refer to TransUnion’s credit reports during the loan approval process. These loans allow individuals to purchase a vehicle without having to pay the full amount upfront. Instead, borrowers can repay the loan over a set period, usually with interest added.

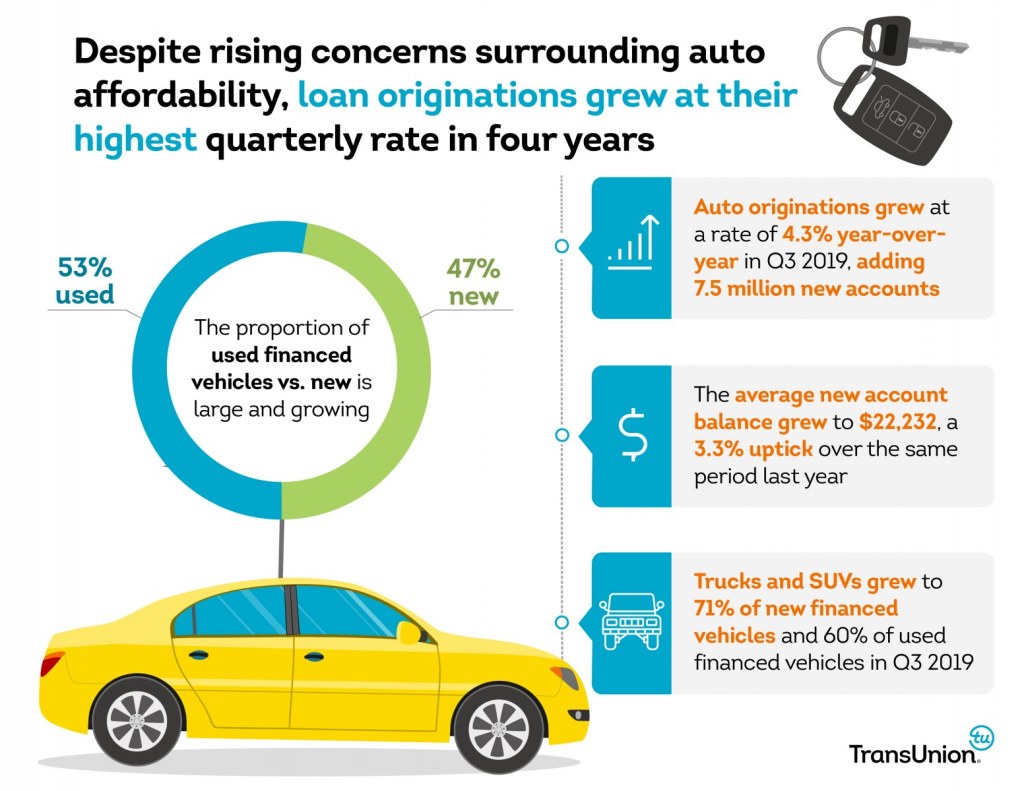

Image Source: presspage.com

🚗 Car loans that use TransUnion provide borrowers with the opportunity to finance their dream cars, even if they don’t have the immediate funds available. This type of loan can be beneficial for individuals who prefer to spread out their payments over time while enjoying the benefits of owning a car.

Advantages of Car Loans That Use TransUnion

1. Flexibility: Car loans that use TransUnion offer borrowers flexibility in terms of repayment options. Lenders often provide various repayment plans, allowing borrowers to choose the one that best suits their financial situation.

2. Improved Credit Score: Successfully repaying a car loan can positively impact your credit score, especially if the lender reports the payments to TransUnion. This can open doors to better interest rates and loan terms in the future.

3. Access to a Wide Network of Lenders: By opting for a car loan that uses TransUnion, borrowers gain access to a broad network of lenders who utilize TransUnion’s credit reports. This increases the chances of finding a suitable loan with favorable terms.

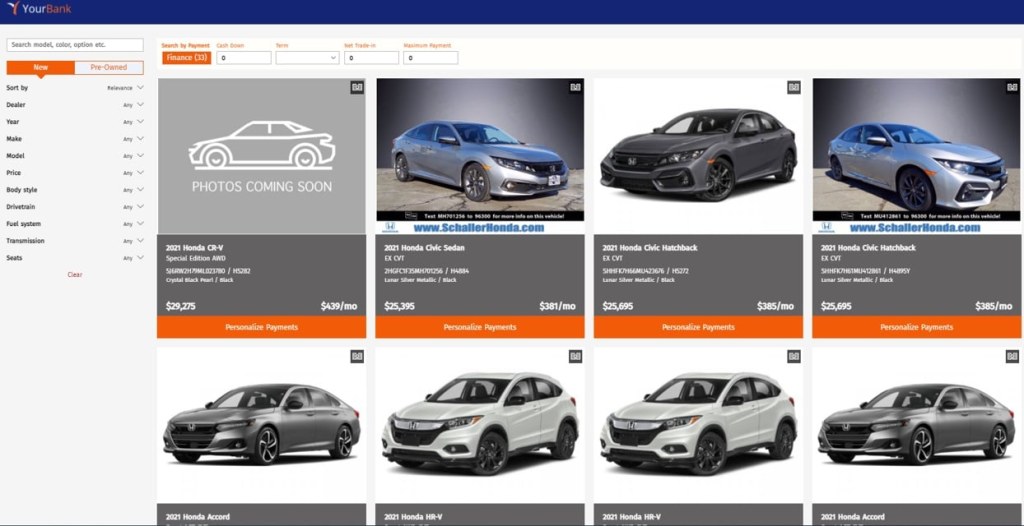

Image Source: autonews.com

4. Competitive Interest Rates: Car loans that use TransUnion often come with competitive interest rates, especially for borrowers with good credit scores. This can result in substantial savings over the life of the loan.

5. Opportunity to Build Credit History: If you are a young adult or someone with limited credit history, a car loan that uses TransUnion can provide an excellent opportunity to establish and build your credit history.

Disadvantages of Car Loans That Use TransUnion

1. Interest Payments: Borrowers must consider the additional cost of interest payments when taking out a car loan. This increases the overall amount repaid compared to purchasing a vehicle outright.

2. Risk of Repossession: Failure to make timely payments on a car loan can result in repossession of the vehicle. It is crucial to ensure that you can comfortably afford the loan payments before committing to the loan.

3. Potential for Negative Credit Impact: Defaulting on a car loan can significantly damage your credit score and make it challenging to secure future loans or credit.

4. Limited Flexibility: Once you commit to a car loan, you are obligated to make the agreed-upon payments until the loan is fully repaid. This can limit your financial flexibility and impact your ability to take on other debts or expenses.

5. Depreciation: Vehicles tend to depreciate over time, meaning their value decreases. If the loan amount is higher than the car’s value, borrowers may find themselves in a situation where they owe more than the car is worth.

FAQs About Car Loans That Use TransUnion

1. Is a high credit score necessary to qualify for a car loan that uses TransUnion?

No, a high credit score is not necessarily required. Lenders consider various factors, including credit history, income, and debt-to-income ratio, when evaluating loan applications.

2. Can I refinance my car loan that uses TransUnion?

Yes, refinancing your car loan that uses TransUnion is possible. However, it’s important to carefully consider the potential benefits and drawbacks before making a decision.

3. Where can I find lenders offering car loans that use TransUnion?

Many banks, credit unions, and online lenders offer car loans that use TransUnion. Researching and comparing different lenders can help you find the best loan terms and interest rates.

4. Can I pay off my car loan early?

Yes, most car loans that use TransUnion allow borrowers to make early repayments without penalties. However, it’s advisable to check the terms and conditions of your specific loan.

5. What documents are required to apply for a car loan that uses TransUnion?

The required documents may vary depending on the lender, but typically, you’ll need proof of income, identification, and details about the vehicle you intend to purchase.

Conclusion

In conclusion, car loans that use TransUnion provide individuals with an opportunity to finance their vehicle purchases while leveraging their credit history. These loans come with advantages such as flexibility, improved credit scores, and access to competitive interest rates. However, borrowers must also consider the disadvantages, including interest payments and the risk of repossession.

Now that you have a comprehensive understanding of car loans that use TransUnion, you can confidently explore your financing options and make informed decisions when buying your next car. Remember to evaluate your financial situation, consider the terms of the loan, and shop around for the best offers. Happy car shopping!

Disclaimer: The information provided in this article is for educational purposes only and should not be considered financial advice. Please consult with a professional financial advisor before making any financial decisions.

This post topic: Used Car