Unlock Affordable Auto Financing With Chartway Used Car Loan Rates – Take Action Now!

Chartway Used Car Loan Rates

Introduction

Hello, Car Enthusiast! Are you looking to finance your dream car? Look no further than Chartway Federal Credit Union. In this article, we will explore the various loan rates offered by Chartway for used cars. So, let’s dive in and discover how Chartway can make your car dreams a reality!

2 Picture Gallery: Unlock Affordable Auto Financing With Chartway Used Car Loan Rates – Take Action Now!

Overview of Chartway Used Car Loan Rates

Before we delve into the details, let’s take a quick look at the overview of Chartway’s used car loan rates. Chartway offers competitive interest rates starting from as low as 3.49% APR. The loan terms range from 36 to 72 months, providing flexibility for borrowers. With Chartway, you can finance your used car purchase with ease and convenience.

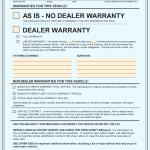

What Are Chartway Used Car Loan Rates?

Image Source: chartway.com

Chartway used car loan rates refer to the interest rates charged by Chartway Federal Credit Union for financing used car purchases. These rates determine the cost of borrowing and vary based on factors such as the borrower’s creditworthiness, loan term, and the age and condition of the car.

Who Can Benefit from Chartway Used Car Loan Rates?

Chartway used car loan rates are designed to cater to a wide range of borrowers. Whether you are a first-time car buyer or a seasoned driver looking to upgrade your vehicle, Chartway offers competitive rates that can suit your needs. Additionally, Chartway provides loan options for individuals with varying credit scores.

When to Consider Chartway Used Car Loan Rates?

Image Source: chartway.com

Chartway used car loan rates are worth considering when you are planning to purchase a used car. Instead of paying the full amount upfront, you can spread the cost over a specified period, making it more affordable. Chartway’s rates are especially beneficial if you are unable to secure a lower interest rate from other lenders.

Where Can You Access Chartway Used Car Loan Rates?

Accessing Chartway used car loan rates is simple. You can visit Chartway’s official website or reach out to their customer service representatives for detailed information. They will guide you through the application process and provide assistance in choosing the best loan option for your needs.

Why Choose Chartway Used Car Loan Rates?

There are several reasons why Chartway used car loan rates should be your top choice. Firstly, their rates are highly competitive compared to other financial institutions. Secondly, Chartway offers flexible loan terms, allowing you to customize your repayment period. Additionally, Chartway provides excellent customer service and personalized guidance throughout the loan process.

How to Apply for Chartway Used Car Loan Rates?

Applying for Chartway used car loan rates is a straightforward process. You can start by filling out an online application form on their website. Ensure you provide accurate information about the car you intend to purchase, your financial details, and personal information. Once submitted, Chartway’s loan officers will review your application and guide you through the next steps.

Advantages of Chartway Used Car Loan Rates

1. Competitive Interest Rates: Chartway offers some of the most competitive interest rates in the market, starting from 3.49% APR.

2. Flexible Loan Terms: Borrowers can choose from a range of loan terms, from 36 to 72 months, depending on their financial situation.

3. Easy Application Process: Applying for a loan with Chartway is hassle-free, with the option to complete an online application.

4. Personalized Assistance: Chartway’s loan officers are dedicated to providing personalized guidance and support throughout the borrowing process.

5. Borrower-Friendly Policies: Chartway offers options for individuals with varying credit scores, making it accessible to a wide range of borrowers.

Disadvantages of Chartway Used Car Loan Rates

1. Membership Requirement: To qualify for a loan with Chartway, individuals must become a member of the credit union, which may involve additional steps.

2. Limited Branch Network: Chartway has a limited physical branch network, which may pose challenges for borrowers who prefer in-person assistance.

Frequently Asked Questions (FAQs)

1. Can I apply for a Chartway used car loan online?

Absolutely! Chartway offers an online application option for convenience and ease of access.

2. Are there any prepayment penalties with Chartway used car loans?

No, Chartway does not charge any prepayment penalties. You can pay off your loan early without incurring additional fees.

3. What factors determine the interest rate for Chartway used car loans?

The interest rate for Chartway used car loans is determined by factors such as creditworthiness, loan term, and the age and condition of the car.

4. How long does the loan approval process take with Chartway?

The loan approval process with Chartway typically takes a few business days, depending on the completeness of your application and the verification process.

5. Can I refinance my existing car loan with Chartway?

Yes, Chartway offers refinancing options for existing car loans. You can explore this option to potentially secure a lower interest rate and save on your monthly payments.

Conclusion

In conclusion, Chartway used car loan rates provide an excellent opportunity for car enthusiasts to finance their dream vehicles. With competitive rates, flexible terms, and personalized assistance, Chartway makes the borrowing process easy and convenient. Whether you are a first-time car buyer or looking to upgrade your current vehicle, Chartway has loan options to suit your needs. Take the first step towards owning your dream car by applying for a Chartway used car loan today!

Final Remarks

The information provided in this article is for informational purposes only and should not be considered financial advice. Interest rates and loan terms are subject to change based on various factors. It is recommended to contact Chartway Federal Credit Union directly for the most accurate and up-to-date information regarding their used car loan rates.

This post topic: Used Car