Unlock Low Rates For Used Cars At Eastman Credit Union: Your Path To Affordable Auto Financing!

Eastman Credit Union Used Car Rates

Introduction

Hello, Car Enthusiast! Are you looking for the best rates for used car loans? Look no further because Eastman Credit Union has got you covered. As one of the leading credit unions in the United States, Eastman Credit Union offers competitive rates and flexible terms for used car financing. In this article, we will explore everything you need to know about Eastman Credit Union used car rates. So, buckle up and let’s dive in!

2 Picture Gallery: Unlock Low Rates For Used Cars At Eastman Credit Union: Your Path To Affordable Auto Financing!

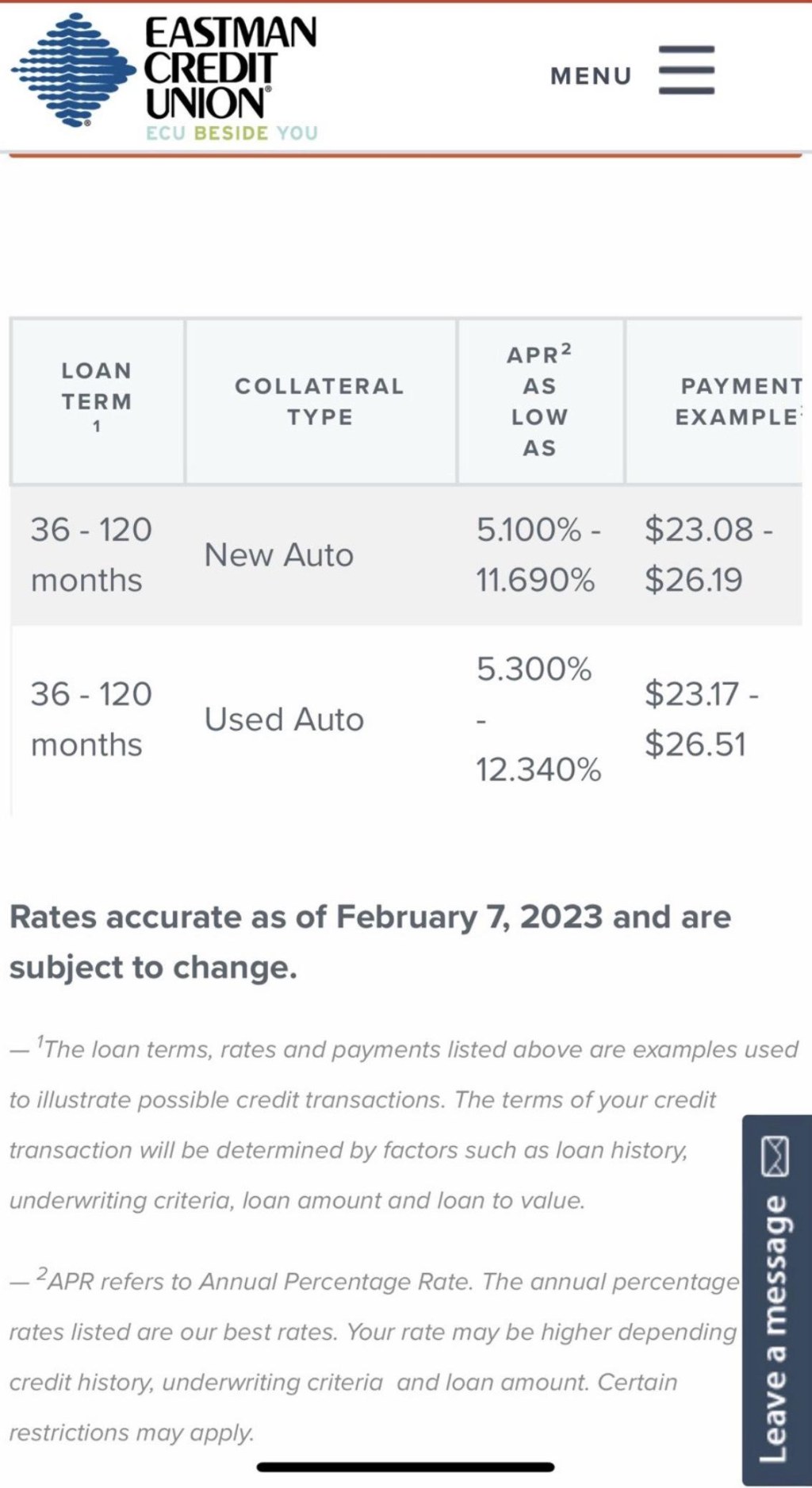

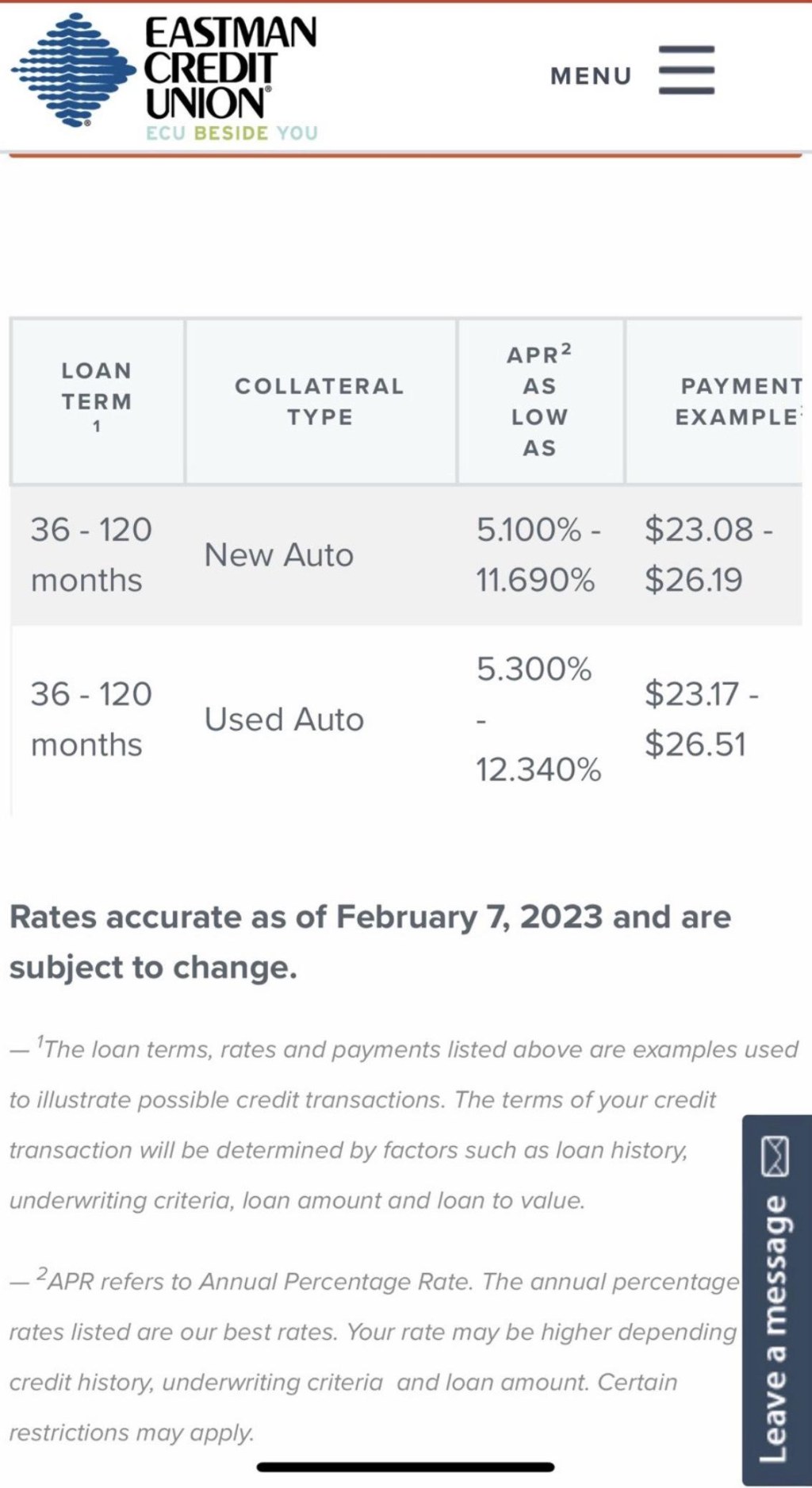

Table: Eastman Credit Union Used Car Rates

Table content goes here…

What is Eastman Credit Union Used Car Rates?

Image Source: amazonaws.com

🚗 Eastman Credit Union Used Car Rates refer to the interest rates and terms offered by Eastman Credit Union for financing used cars. Whether you are buying from a dealership or a private seller, Eastman Credit Union provides attractive loan options to help you finance your dream car.

Interest Rates

📈 Eastman Credit Union offers competitive interest rates for used car loans. Rates may vary depending on factors such as the borrower’s creditworthiness and the age of the vehicle. Generally, the better your credit score, the lower the interest rate you can qualify for.

Loan Terms

Image Source: ecu.org

⌛️ Eastman Credit Union offers flexible loan terms for used car financing. You can choose from various repayment periods, ranging from 12 to 84 months. Longer loan terms may result in lower monthly payments but may also accrue more interest over time.

Who Can Benefit from Eastman Credit Union Used Car Rates?

🤔 Eastman Credit Union used car rates are beneficial for individuals who want to purchase a pre-owned vehicle. Whether you are a first-time buyer or looking to upgrade your current car, Eastman Credit Union offers affordable financing options that can fit your budget.

Members

Image Source: ecu.org

👥 Eastman Credit Union used car rates are exclusively available to its members. To become a member, you must meet certain eligibility requirements and open a share savings account with a minimum deposit. Once a member, you can take advantage of the attractive rates and benefits offered by the credit union.

Good Credit Borrowers

🌟 Borrowers with good credit scores can benefit from lower interest rates and better loan terms. If you have a strong credit history, Eastman Credit Union used car rates can help you save money on your car financing. It’s always a good idea to check your credit score before applying for a loan.

When Can You Apply for Eastman Credit Union Used Car Rates?

⏰ You can apply for Eastman Credit Union used car rates at any time when you are ready to purchase a used car. Whether you have already found your dream car or are still searching, Eastman Credit Union can provide you with pre-approval for a loan, giving you more negotiating power when it comes to the purchase.

Pre-Approval Process

📝 The pre-approval process for Eastman Credit Union used car rates is simple and straightforward. You can apply online, over the phone, or in person at one of their branch locations. You will need to provide information about yourself, your employment, and your financial situation. Once approved, you will receive a pre-approval letter stating the loan amount and terms you qualify for.

Final Loan Approval

✅ After finding the perfect used car and agreeing on the purchase price, you can finalize the loan approval with Eastman Credit Union. The credit union will verify the details of the car and may require additional documentation. Once everything is in order, the loan will be funded, and you can drive away in your new vehicle.

Where Can You Apply for Eastman Credit Union Used Car Rates?

🌐 Applying for Eastman Credit Union used car rates is convenient and accessible. You can apply online through their website, visit one of their branch locations, or contact their customer service for assistance. Eastman Credit Union is based in Tennessee but serves members nationwide, providing a seamless borrowing experience.

Online Application

💻 The online application process for Eastman Credit Union used car rates is user-friendly. You will need to provide all the necessary information and documents electronically. The credit union’s secure website ensures the safety of your personal and financial information.

Branch Locations

🏦 If you prefer a face-to-face interaction, you can visit one of Eastman Credit Union’s branch locations. Their friendly staff will guide you through the application process and answer any questions you may have. You can also discuss your financing options in person and get personalized assistance.

Why Choose Eastman Credit Union Used Car Rates?

🏆 Eastman Credit Union used car rates offer several advantages that make them an excellent choice for financing your used car purchase. However, it is essential to consider both the pros and cons before making a decision.

Advantages

✅ Competitive interest rates

✅ Flexible loan terms

✅ Exclusive member benefits

✅ Convenient application process

✅ Nationwide accessibility

Disadvantages

❌ Membership eligibility requirements

❌ Limited physical branch locations

How Can You Make the Most of Eastman Credit Union Used Car Rates?

💡 To make the most of Eastman Credit Union used car rates, consider the following tips:

Check Your Credit Score

📊 Before applying for a loan, check your credit score to ensure you qualify for the best rates. If your score needs improvement, take steps to enhance it before submitting your application.

Compare Loan Offers

🔍 Don’t settle for the first loan offer you receive. Shop around and compare rates, terms, and fees from different lenders, including banks and credit unions. This will help you find the best deal for your used car financing.

Get Pre-Approved

📋 Getting pre-approved for a loan gives you an advantage when negotiating with car sellers. It also allows you to set a realistic budget and focus on vehicles within your price range.

Consider Additional Costs

💰 Remember to consider the additional costs of owning a used car, such as insurance, maintenance, and fuel. Factor these expenses into your budget to ensure you can comfortably afford the loan payments.

FAQs about Eastman Credit Union Used Car Rates

1. Can I apply for a used car loan with Eastman Credit Union if I am not a member?

No, Eastman Credit Union used car rates are exclusively available to its members. However, becoming a member is a straightforward process, and the benefits are worth it.

2. How long does the loan approval process take?

The loan approval process can vary depending on various factors. In some cases, you can get pre-approved within minutes. Final approval may take a couple of days, depending on the verification process and documentation required.

3. Can I refinance my existing used car loan with Eastman Credit Union?

Yes, Eastman Credit Union offers refinancing options for existing used car loans. Refinancing can help you save money by securing a lower interest rate or extending the loan term.

4. Are there any penalties for early loan repayment?

No, Eastman Credit Union does not charge any penalties for early loan repayment. You can pay off your loan ahead of schedule without incurring any additional fees.

5. What other services does Eastman Credit Union offer?

Eastman Credit Union offers a wide range of financial services, including savings accounts, checking accounts, credit cards, mortgages, and personal loans. They also provide online banking and mobile banking options for added convenience.

Conclusion

In conclusion, Eastman Credit Union used car rates offer competitive interest rates and flexible terms for financing your dream car. With convenient application options and exclusive membership benefits, Eastman Credit Union is a top choice for individuals looking to purchase a used vehicle. Remember to compare loan offers, check your credit score, and consider additional costs before making a decision. Take advantage of Eastman Credit Union’s attractive rates and start driving your dream car today!

Final Remarks

Disclaimer: The information provided in this article is for informational purposes only. The rates and terms mentioned may be subject to change. It is always advisable to contact Eastman Credit Union or visit their official website for the most up-to-date and accurate information.

This post topic: Used Car