Unlock Amazing PFCU Used Car Loan Rates Now: Your Key To Affordable Wheels!

PFCU Used Car Loan Rates: Everything You Need to Know

Introduction

Dear Car Enthusiast,

2 Picture Gallery: Unlock Amazing PFCU Used Car Loan Rates Now: Your Key To Affordable Wheels!

Welcome to a comprehensive guide on PFCU used car loan rates. If you are in the market for a used car and considering financing options, you’ve come to the right place. In this article, we will delve into the details of PFCU’s loan rates, providing you with all the information you need to make an informed decision. Whether you’re a car lover looking to upgrade your ride or a first-time buyer exploring the world of used cars, this guide will serve as your ultimate resource.

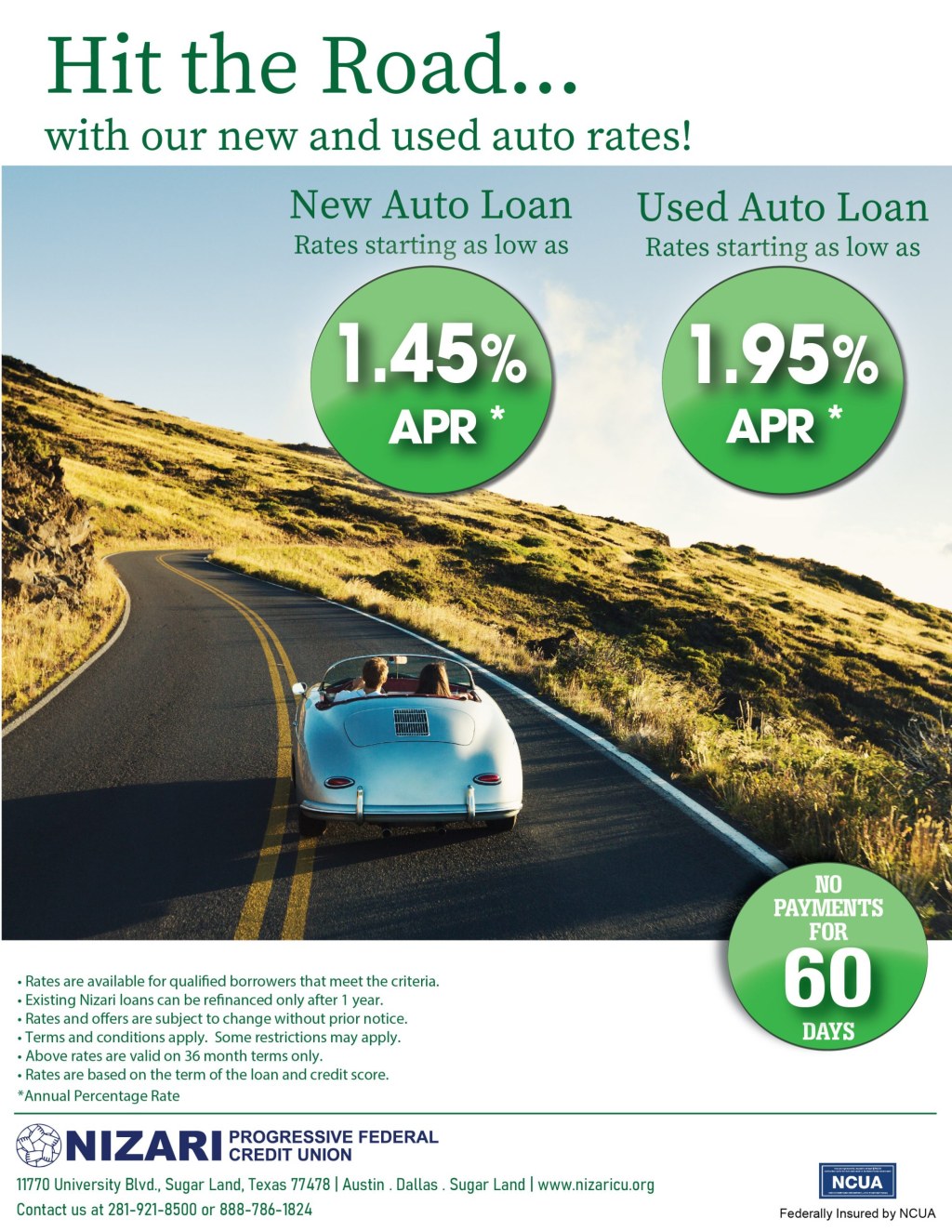

Image Source: fbsbx.com

Now, let’s jump right into it and explore the world of PFCU used car loan rates.

What are PFCU Used Car Loan Rates?

🔍 PFCU used car loan rates refer to the interest rates charged by the Philadelphia Federal Credit Union for financing the purchase of pre-owned vehicles.

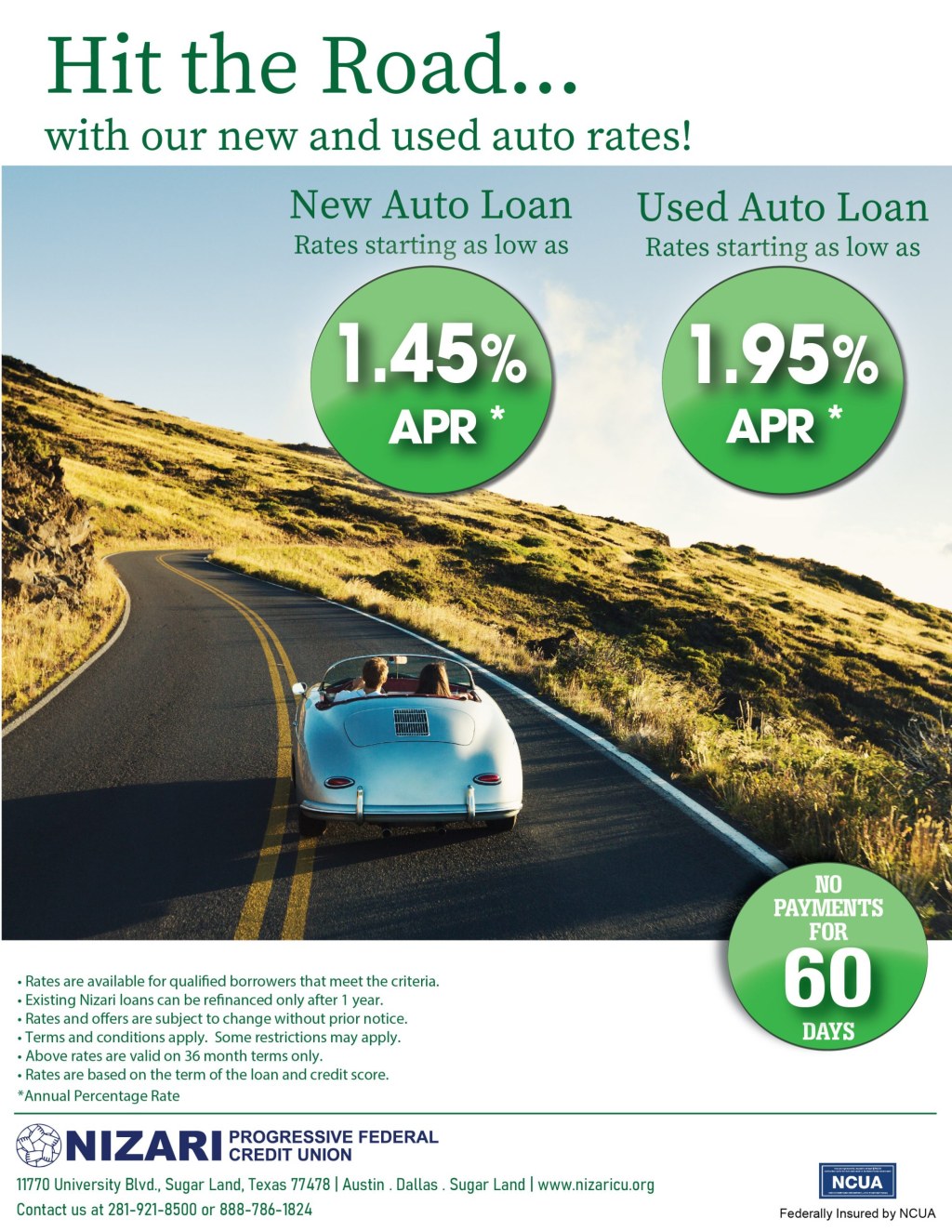

Image Source: nizaricu.org

PFCU offers competitive loan rates that enable car enthusiasts like yourself to obtain the necessary funds to buy the used car of your dreams. These rates are determined based on various factors, including credit history, loan term, and the age of the vehicle. Understanding the intricacies of PFCU used car loan rates will help you assess whether this financing option aligns with your needs and financial goals.

Who Can Benefit from PFCU Used Car Loan Rates?

🚗 PFCU used car loan rates are designed to cater to a wide range of individuals, including:

Image Source: nizaricu.org

Car enthusiasts looking to upgrade their current vehicle

First-time buyers entering the world of used cars

Individuals with limited budgets seeking affordable financing options

Those who prefer to purchase pre-owned vehicles

Regardless of your background or financial situation, PFCU used car loan rates offer an accessible and flexible solution for financing your used car purchase.

When Should You Consider PFCU Used Car Loan Rates?

⏰ There are several scenarios in which PFCU used car loan rates may be the right choice for you:

When you find a used car that meets your preferences and budget

If your credit score allows you to qualify for favorable loan terms

When you are confident in your ability to repay the loan within the agreed-upon timeframe

By carefully evaluating your circumstances, you can determine whether PFCU used car loan rates are the ideal fit for your car financing needs.

Where Can You Access PFCU Used Car Loan Rates?

🌐 PFCU used car loan rates can be accessed directly through the Philadelphia Federal Credit Union’s website or by visiting one of their branches. You can explore the available rates, calculate your monthly payments, and apply for a loan online. Additionally, PFCU’s friendly staff is always ready to assist you in person.

Whether you prefer the convenience of online applications or the personal touch of face-to-face interactions, PFCU ensures that their used car loan rates are within reach.

Why Choose PFCU for Your Used Car Loan Needs?

🏆 There are several compelling reasons why PFCU stands out as an excellent choice for used car financing:

Competitive interest rates that help you save money in the long run

Flexible loan terms that accommodate your specific financial situation

Transparent and straightforward application process

Excellent customer service to guide you through every step of the process

PFCU’s commitment to providing exceptional service and favorable loan terms sets them apart from other financial institutions, making them a trusted partner in your used car buying journey.

How to Apply for a PFCU Used Car Loan?

📝 Applying for a PFCU used car loan is a simple and straightforward process:

Gather all the necessary documents, including identification, proof of income, and the vehicle’s details.

Visit the PFCU website or a branch to access the loan application.

Fill out the application form accurately, providing all requested information.

Submit the completed application along with the required documentation.

Await PFCU’s review and approval of your loan application.

Once approved, carefully review the loan terms and conditions before signing the agreement.

Upon agreement, the funds will be disbursed, allowing you to purchase your desired used car.

Advantages and Disadvantages of PFCU Used Car Loan Rates

✅🚫 Like any financing option, PFCU used car loan rates come with their own set of advantages and disadvantages. Let’s explore them in detail:

Advantages: Pros of PFCU Used Car Loan Rates

1. Competitive interest rates: PFCU offers rates that are often more favorable compared to traditional banks, allowing you to save money.

2. Flexible loan terms: You can choose a loan term that suits your financial situation, giving you more control over your monthly payments.

3. Easy application process: PFCU provides a streamlined online application process, making it convenient and hassle-free to apply for a loan.

4. Personalized customer service: PFCU’s knowledgeable staff is committed to helping you navigate the loan process and address any questions or concerns you may have.

5. Trustworthy reputation: PFCU has a long-standing reputation as a reliable and trustworthy financial institution, giving you peace of mind throughout the loan process.

Disadvantages: Cons of PFCU Used Car Loan Rates

1. Membership requirement: To access PFCU’s used car loan rates, you need to be a member of the Philadelphia Federal Credit Union, which may involve additional steps.

2. Limited availability: PFCU used car loan rates are specific to the Philadelphia area, meaning they may not be accessible to individuals outside this region.

3. Eligibility criteria: To qualify for the best loan rates, you need to meet certain creditworthiness criteria, which may limit some individuals’ options.

4. Pre-owned vehicle restrictions: PFCU may have restrictions on the age or condition of the used car you can finance with their loan rates, potentially limiting your options.

5. Potential fees: While PFCU strives to provide transparent loan terms, it’s essential to review the contract carefully to understand any potential fees or charges associated with the loan.

Frequently Asked Questions (FAQs)

Q1: Can I apply for a PFCU used car loan if I have a low credit score?

A1: Yes, PFCU considers applicants with various credit scores. However, keep in mind that a lower credit score may result in less favorable loan terms.

Q2: How long does it take to receive a decision on my PFCU used car loan application?

A2: PFCU aims to provide prompt decisions on loan applications, with most applicants receiving a response within a few business days.

Q3: Are there any penalties for early repayment of my PFCU used car loan?

A3: PFCU does not impose penalties for early loan repayment, allowing you to save on interest by paying off your loan ahead of schedule.

Q4: Can I use a PFCU used car loan to finance a vehicle from a private seller?

A4: Yes, PFCU used car loan rates can be used to finance both dealership purchases and private seller transactions.

Q5: How can I join the Philadelphia Federal Credit Union to access their used car loan rates?

A5: To become a member, you typically need to meet specific eligibility criteria, such as living, working, or attending school in the Philadelphia area. Consult PFCU’s website or contact their customer service for detailed information.

Conclusion

In conclusion, PFCU used car loan rates offer an attractive financing option for car enthusiasts like you. With competitive rates, flexible terms, and a user-friendly application process, PFCU aims to make your used car buying experience smooth and affordable. Whether you’re upgrading your current vehicle or venturing into the world of used cars for the first time, PFCU provides the financial support you need.

So, don’t let financing hold you back from your dream car. Explore PFCU’s used car loan rates today and take that important step towards driving your ideal pre-owned vehicle.

Final Remarks

📢 The information provided in this article is for informational purposes only and should not be considered financial advice. Rates, terms, and eligibility criteria are subject to change without notice. It is essential to conduct thorough research and consult with a financial professional before making any financial decisions.

This post topic: Used Car