Unlock Exclusive Insights: Discover Which Car Dealerships Use TransUnion To Boost Your Buying Power

What Car Dealerships Use TransUnion

Introduction

Dear Readers,

3 Picture Gallery: Unlock Exclusive Insights: Discover Which Car Dealerships Use TransUnion To Boost Your Buying Power

Welcome to our informative article on car dealerships that use TransUnion, one of the leading consumer credit reporting agencies. In today’s fast-paced world, where purchasing a car is a significant investment, it is crucial to have access to accurate and reliable information about potential buyers. TransUnion provides car dealerships with comprehensive credit reports, enabling them to make informed decisions and streamline their financing processes. In this article, we will delve into the details of what car dealerships use TransUnion and how it benefits both dealerships and customers.

Image Source: allaboutcareers.com

So, without further ado, let’s explore the world of TransUnion and its impact on the automotive industry.

Table of Contents

What is TransUnion?

Who Uses TransUnion?

When is TransUnion Utilized?

Where Can TransUnion Reports Be Accessed?

Why Do Car Dealerships Rely on TransUnion?

How Does TransUnion Benefit Car Dealerships and Customers?

Advantages and Disadvantages of Using TransUnion

Frequently Asked Questions (FAQ)

Conclusion

Final Remarks

What is TransUnion? 📊

Image Source: transunion.co.za

TransUnion is a global credit reporting agency that collects and analyzes consumer credit information. It provides credit reports, scores, and solutions to businesses and individuals, helping them make informed financial decisions. By gathering data from various sources, including lenders, creditors, and public records, TransUnion creates comprehensive profiles that highlight individuals’ creditworthiness.

These profiles contain valuable information, such as credit history, outstanding debts, payment behavior, and public records. Car dealerships rely on TransUnion to assess potential buyers’ creditworthiness and determine the likelihood of timely payments. This information plays a crucial role in financing decisions and helps dealerships manage risks effectively.

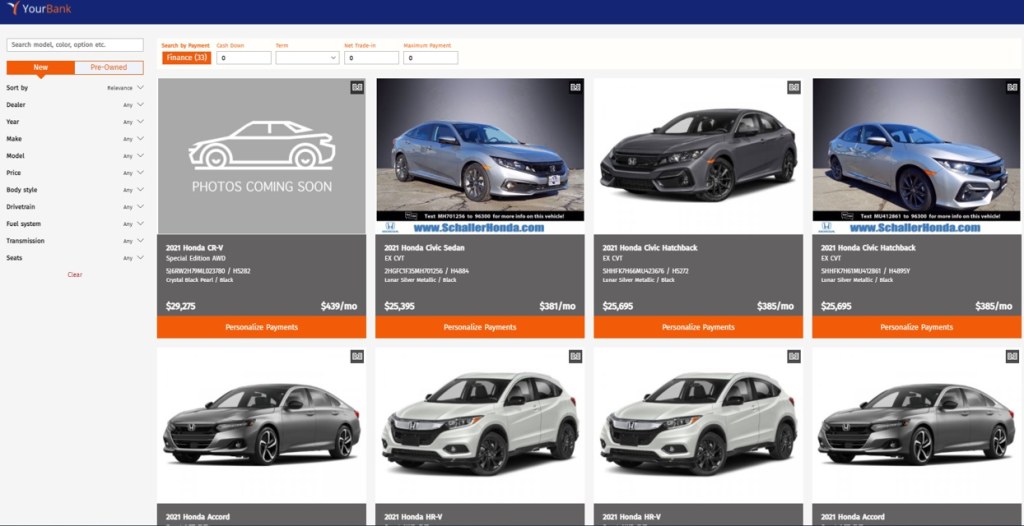

Who Uses TransUnion? 🚗

Image Source: autonews.com

Car dealerships of all sizes and types utilize TransUnion’s services to streamline their operations and mitigate credit risks. Whether it’s a small independent dealership or a large national chain, TransUnion provides the necessary tools and information to assess the creditworthiness of prospective buyers. By partnering with TransUnion, dealerships can access accurate credit reports and make informed decisions regarding financing options for their customers.

Additionally, financial institutions, including banks and credit unions, also rely on TransUnion to evaluate loan applicants’ creditworthiness. This enables them to offer competitive interest rates and tailor financing options to suit individual customers’ needs.

When is TransUnion Utilized? ⌚

TransUnion is typically utilized in the early stages of the car buying process when potential buyers apply for financing. Once a buyer expresses interest in purchasing a vehicle and submits a credit application, the dealership accesses the buyer’s credit report from TransUnion. This report provides valuable insights into the buyer’s financial health and helps the dealership evaluate their creditworthiness.

TransUnion reports can also be accessed when dealerships are considering extending credit to existing customers or when they need to reassess a customer’s creditworthiness for potential trade-in or additional purchases.

Where Can TransUnion Reports Be Accessed? 🌐

TransUnion reports can be accessed online through TransUnion’s website or through integrated software systems specifically designed for car dealerships. These software systems allow dealerships to pull credit reports seamlessly and integrate them with their own customer management systems. This streamlines the financing process and eliminates the need for manual data entry.

Furthermore, TransUnion offers mobile applications that enable dealerships to access credit reports on the go, making it even more convenient for dealerships to retrieve and review vital credit information.

Why Do Car Dealerships Rely on TransUnion? ❓

Car dealerships rely on TransUnion for several reasons:

Reliable Credit Information: TransUnion provides accurate and reliable credit information, enabling dealerships to make well-informed decisions regarding financing options.

Streamlined Financing Process: By integrating TransUnion’s credit reports into their systems, dealerships can streamline the financing process, reducing paperwork and manual data entry.

Reduced Credit Risk: TransUnion reports allow dealerships to assess potential buyers’ creditworthiness and evaluate the risk associated with extending credit. This helps dealerships mitigate financial risks effectively.

Competitive Advantage: Utilizing TransUnion’s services gives car dealerships a competitive edge by offering efficient financing solutions and providing comprehensive credit assessment to potential buyers.

How Does TransUnion Benefit Car Dealerships and Customers? 🤝

TransUnion benefits both car dealerships and customers in the following ways:

Efficient Financing: By providing accurate credit information, TransUnion helps dealerships offer financing options tailored to each customer’s creditworthiness.

Increased Approval Rates: TransUnion’s comprehensive credit reports enable dealerships to evaluate alternative credit factors and increase the chances of loan approvals for customers with limited credit histories.

Improved Customer Experience: With quick access to credit reports, dealerships can expedite the financing process, improving the overall customer experience.

Enhanced Transparency: TransUnion reports provide transparency, ensuring that both dealerships and customers have a clear understanding of the financing terms and conditions.

Advantages and Disadvantages of Using TransUnion ✅❌

Advantages:

Accurate Credit Information: TransUnion provides reliable credit information, allowing dealerships to make informed financing decisions.

Streamlined Processes: By integrating TransUnion’s services, dealerships can streamline their financing processes and reduce paperwork.

Reduced Risk: TransUnion reports help dealerships assess creditworthiness and mitigate potential risks associated with extending credit.

Increased Sales Opportunities: Access to TransUnion’s credit reports can help dealerships identify customers who are eligible for financing, increasing their sales opportunities.

Disadvantages:

Cost: Utilizing TransUnion’s services comes at a cost, which can be a disadvantage for smaller dealerships with limited budgets.

Reliance on Third-Party Data: Dealerships must trust and rely on the accuracy of the credit information provided by TransUnion.

Frequently Asked Questions (FAQ) ❓

Q1: Can car dealerships access TransUnion reports for free?

A1: No, accessing TransUnion reports requires a subscription or payment.

Q2: Are TransUnion credit scores used by car dealerships?

A2: Yes, TransUnion credit scores are considered by car dealerships when assessing creditworthiness.

Q3: Can TransUnion reports be accessed by individuals?

A3: Yes, individuals can access their TransUnion credit reports directly from TransUnion’s website or through authorized credit monitoring services.

Q4: Do all car dealerships use TransUnion?

A4: No, car dealerships have the option to use different credit reporting agencies based on their preferences and business needs.

Q5: Can TransUnion reports be used for leasing applications?

A5: Yes, TransUnion reports can be used for both financing and leasing applications, providing valuable credit information to car dealerships.

Conclusion

In conclusion, TransUnion plays a pivotal role in the automotive industry, providing car dealerships with accurate and comprehensive credit reports. By utilizing TransUnion’s services, dealerships can make informed financing decisions, streamline their processes, and mitigate credit risks. Both dealerships and customers benefit from the efficiency and transparency offered by TransUnion, resulting in a smoother car buying experience for all parties involved.

Final Remarks

Dear Readers,

We hope this article has shed light on the importance of TransUnion for car dealerships and its impact on the automotive industry. As customers, it is essential to understand the role credit reporting agencies play in financing decisions and be aware of our creditworthiness. Remember to regularly monitor your credit reports and maintain a healthy financial profile.

Thank you for joining us on this informative journey, and we wish you all the best in your car buying endeavors.

This post topic: Used Car