Discover Which Car Loans Use Equifax To Get On The Road Of Your Dreams!

What Car Loans Use Equifax?

Introduction

Dear Car Enthusiast,

2 Picture Gallery: Discover Which Car Loans Use Equifax To Get On The Road Of Your Dreams!

Are you planning to finance your dream car? If so, it’s crucial to understand the role of credit bureaus in the car loan process. Equifax, one of the major credit reporting agencies, plays a significant role in determining your eligibility for car loans. In this article, we will explore what car loans use Equifax and how it impacts your borrowing options.

Image Source: cashlady.com

Now, let’s dive into the details and learn more about Equifax and its influence on car loans.

What is Equifax?

Equifax is a well-known credit reporting agency that collects and maintains information on individuals’ credit history. Lenders and financial institutions rely on Equifax’s reports to assess the creditworthiness of loan applicants, including those seeking car loans.

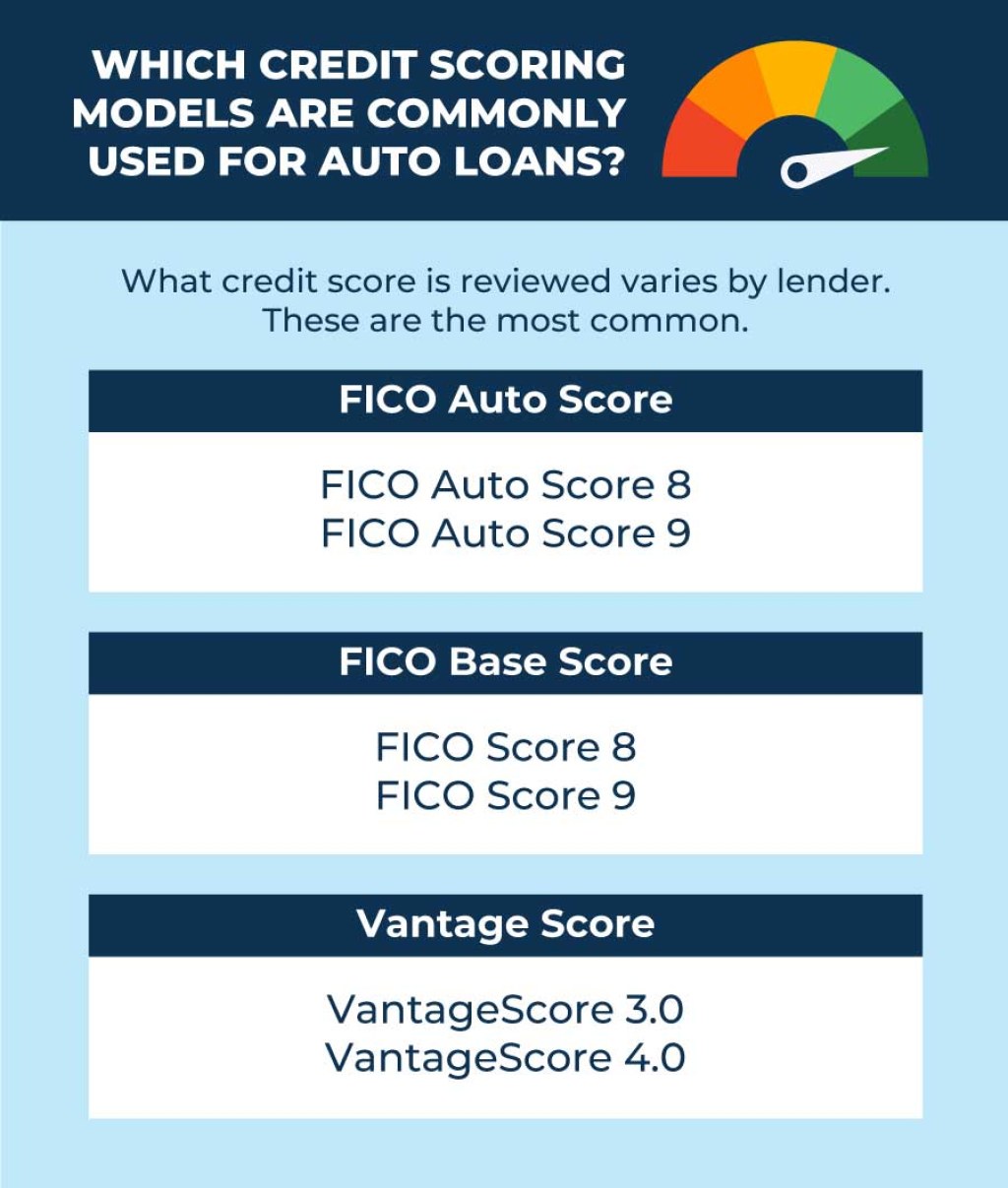

Image Source: ctfassets.net

✨ Key Point: Equifax provides a comprehensive credit profile that helps lenders evaluate the risk associated with lending money to potential car buyers.

Who Uses Equifax for Car Loans?

Several lenders, including banks, credit unions, and auto finance companies, use Equifax’s credit reports when considering car loan applications. These lenders rely on Equifax’s data to assess the borrower’s creditworthiness and to determine the interest rates and loan terms they offer.

✨ Key Point: Car loan providers use Equifax to evaluate your creditworthiness and determine the terms of your loan.

When is Equifax Used for Car Loans?

Equifax is typically used during the car loan application process, specifically when you authorize the lender to pull your credit report. This usually happens after you’ve submitted a loan application and provided the necessary personal and financial information.

✨ Key Point: Equifax is accessed by lenders when you apply for a car loan and give them permission to review your credit report.

Where Can You Get Car Loans That Use Equifax?

You can obtain car loans that use Equifax from various sources, including traditional financial institutions such as banks and credit unions. Additionally, many dealerships offer in-house financing options that may also rely on Equifax’s credit reports.

✨ Key Point: You can find car loans that use Equifax through banks, credit unions, and dealerships that offer in-house financing.

Why Do Car Loans Use Equifax?

Car loans use Equifax because it provides lenders with a detailed credit history of the loan applicants. By evaluating this information, lenders can assess the risk involved in lending money to potential car buyers. Equifax’s reports include factors such as payment history, outstanding debts, and credit utilization, which help lenders make informed decisions about whether to approve the loan and what terms to offer.

✨ Key Point: Equifax’s credit reports provide crucial information that helps lenders evaluate the risk associated with car loan applicants.

How Does Equifax Impact Car Loan Applications?

Equifax plays a significant role in car loan applications. Your credit history, as reported by Equifax, directly influences the interest rates, loan terms, and loan amounts you may qualify for. A good credit history can result in lower interest rates and better loan terms, while a poor credit history may lead to higher interest rates or even loan rejection.

✨ Key Point: Equifax’s credit reports influence the terms and conditions of your car loan, including the interest rates and loan amounts you are eligible for.

Advantages and Disadvantages of Car Loans Using Equifax

Advantages:

Access to a wide range of lenders: Using Equifax allows you to explore numerous lenders who rely on their credit reports, increasing your chances of finding competitive loan terms.

Transparent evaluation process: Equifax’s credit reports provide lenders with a clear picture of your creditworthiness, ensuring a fair evaluation process.

Potential for better loan terms: If you have a strong credit history, lenders using Equifax may offer you lower interest rates and more favorable loan terms.

Disadvantages:

Impact of negative credit history: If you have a poor credit history, lenders relying on Equifax may offer you higher interest rates or reject your loan application altogether.

Limited borrowing options: Not all lenders use Equifax, so relying solely on Equifax may restrict your access to certain car loan providers.

Frequently Asked Questions about Car Loans Using Equifax

Q: Can I get a car loan if I have bad credit according to Equifax?

A: Yes, you may still be able to secure a car loan with bad credit, but you may face higher interest rates and stricter loan terms.

Q: How often should I check my Equifax credit report?

A: It is recommended to check your Equifax credit report at least once a year to ensure its accuracy and address any discrepancies.

Q: Can I dispute any errors on my Equifax credit report?

A: Yes, you have the right to dispute any errors on your Equifax credit report. You can do so by contacting Equifax directly and providing supporting documentation.

Q: Does Equifax consider my income when evaluating my car loan application?

A: While Equifax does not directly assess your income, lenders using Equifax may consider it along with other factors when evaluating your car loan application.

Q: Can Equifax reports be accessed by employers or landlords?

A: In most cases, employers and landlords do not have access to your Equifax credit reports without your explicit consent.

Conclusion

Car loans that use Equifax provide lenders with valuable insights into your creditworthiness and help them make informed decisions about your loan. By understanding how Equifax impacts the car loan process, you can proactively manage your credit and increase your chances of securing favorable loan terms.

Now that you’re equipped with knowledge about what car loans use Equifax, take the necessary steps to improve your credit score and explore your borrowing options wisely. Remember, a well-informed borrower is a smart borrower!

Final Remarks

Car loans are a significant financial commitment, and it’s essential to carefully consider your options before making a decision. This article has provided you with valuable information about car loans that use Equifax, but it’s crucial to conduct further research and seek professional advice based on your individual circumstances.

The information provided in this article is for informational purposes only and does not constitute financial or legal advice. Always consult with qualified professionals before making any financial decisions.

This post topic: Used Car