Maximize Your Benefits: Opt For Our Loss Of Use Car Insurance Claim For Hassle-Free Coverage And Quick Compensation!

Loss of Use Car Insurance Claim

Introduction

Dear Car Enthusiast,

Welcome to our informative article on loss of use car insurance claim. In this article, we will provide you with a comprehensive understanding of what loss of use car insurance claims are and how they can benefit you as a car owner. We will delve into the various aspects of this type of insurance claim, including its purpose, eligibility, and the process involved in making a claim.

3 Picture Gallery: Maximize Your Benefits: Opt For Our Loss Of Use Car Insurance Claim For Hassle-Free Coverage And Quick Compensation!

We understand that as a car lover, your vehicle is more than just a mode of transportation. It is an essential part of your daily life and plays a significant role in your routine activities. Therefore, it is crucial to ensure that you have the necessary insurance coverage to protect your car in the event of unforeseen circumstances.

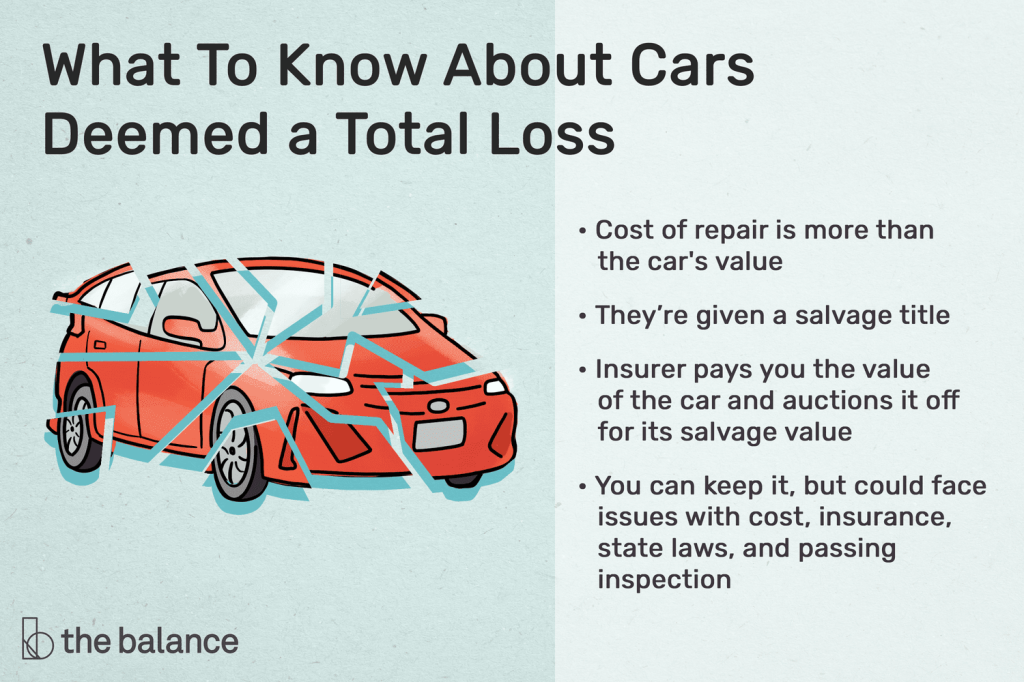

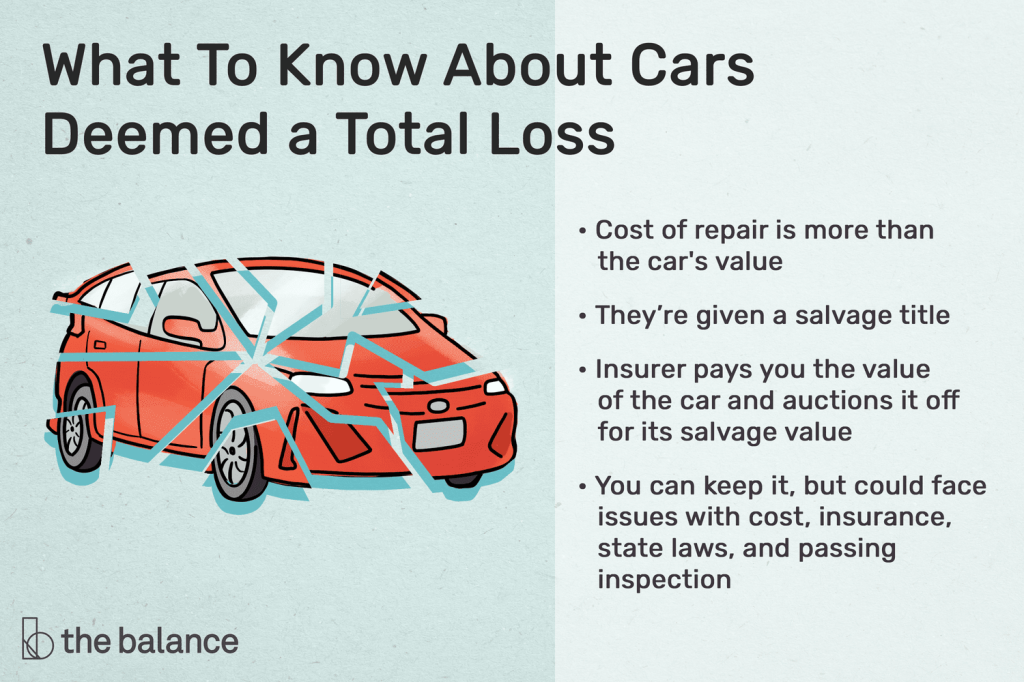

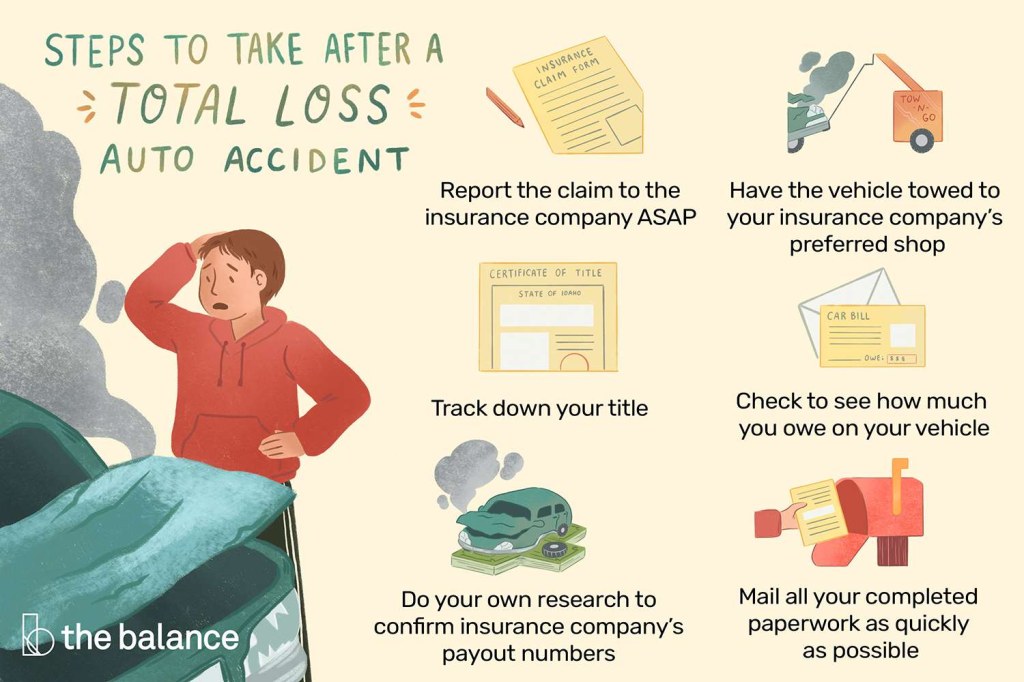

Loss of use car insurance claim is designed to provide compensation for the expenses you may incur while your car is being repaired or replaced after an accident or theft. It covers expenses such as rental car fees or alternative transportation costs, allowing you to maintain your daily activities without disruption.

Image Source: thebalancemoney.com

In the following sections, we will explore the details of loss of use car insurance claim, including its definition, eligibility requirements, benefits, and potential drawbacks. By the end of this article, you will have a clear understanding of how this type of insurance claim works and whether it is suitable for your specific needs.

Table of Contents

Introduction

What is a Loss of Use Car Insurance Claim?

Who is Eligible for a Loss of Use Car Insurance Claim?

When Can You Make a Loss of Use Car Insurance Claim?

Where Can You Make a Loss of Use Car Insurance Claim?

Why Should You Consider a Loss of Use Car Insurance Claim?

How to Make a Loss of Use Car Insurance Claim?

Advantages and Disadvantages of Loss of Use Car Insurance Claim

FAQs

Conclusion

Final Remarks

What is a Loss of Use Car Insurance Claim?

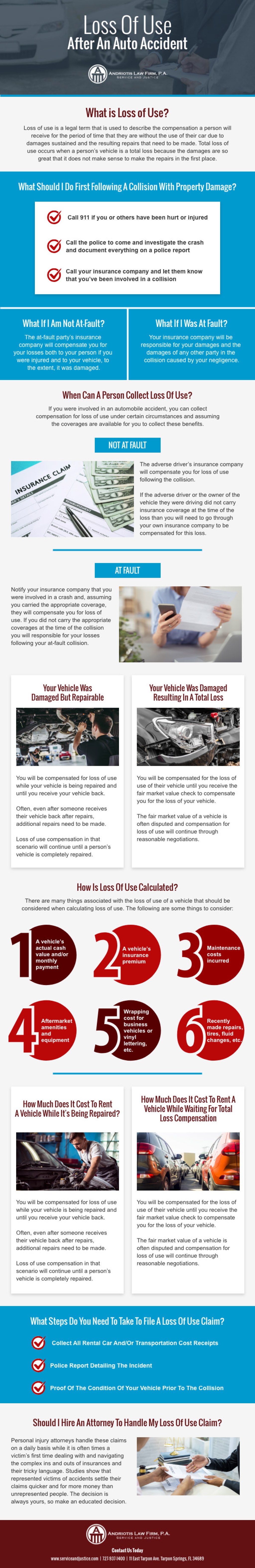

A loss of use car insurance claim is a type of insurance claim that compensates car owners for the expenses they may incur while their vehicle is being repaired or replaced after an accident or theft. It covers the costs associated with renting a car or using alternative transportation during the period when their car is unavailable.

Image Source: thebalancemoney.com

This insurance claim is essential because it ensures that car owners can continue their daily activities without disruptions, even when their own vehicles are not usable. It provides financial assistance to cover the expenses of renting a car or using public transportation, allowing car owners to maintain their mobility while their cars are undergoing repairs or replacements.

Loss of use car insurance claim is typically included as part of comprehensive car insurance policies. However, it is important to review your specific policy terms and conditions to ensure that this coverage is included and to understand the limitations and requirements for making a claim.

Who is Eligible for a Loss of Use Car Insurance Claim?

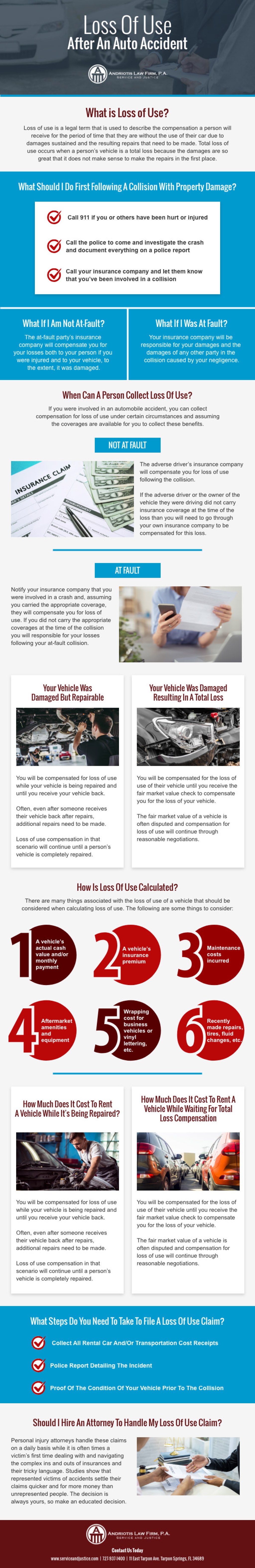

Eligibility for a loss of use car insurance claim varies depending on the specific insurance policy and the circumstances surrounding the claim. In general, individuals who have comprehensive car insurance coverage and experience a covered event that renders their vehicle unusable are eligible to make a loss of use car insurance claim.

It is important to note that eligibility may be subject to certain conditions and limitations. These conditions may include factors such as the cause of the car’s unavailability, the duration of the repairs or replacement, and the availability of rental cars or alternative transportation options.

Image Source: serviceandjustice.com

To determine your eligibility for a loss of use car insurance claim, it is recommended to review your insurance policy or consult with your insurance provider. They will be able to provide you with specific information regarding your coverage and the requirements for making a claim.

When Can You Make a Loss of Use Car Insurance Claim?

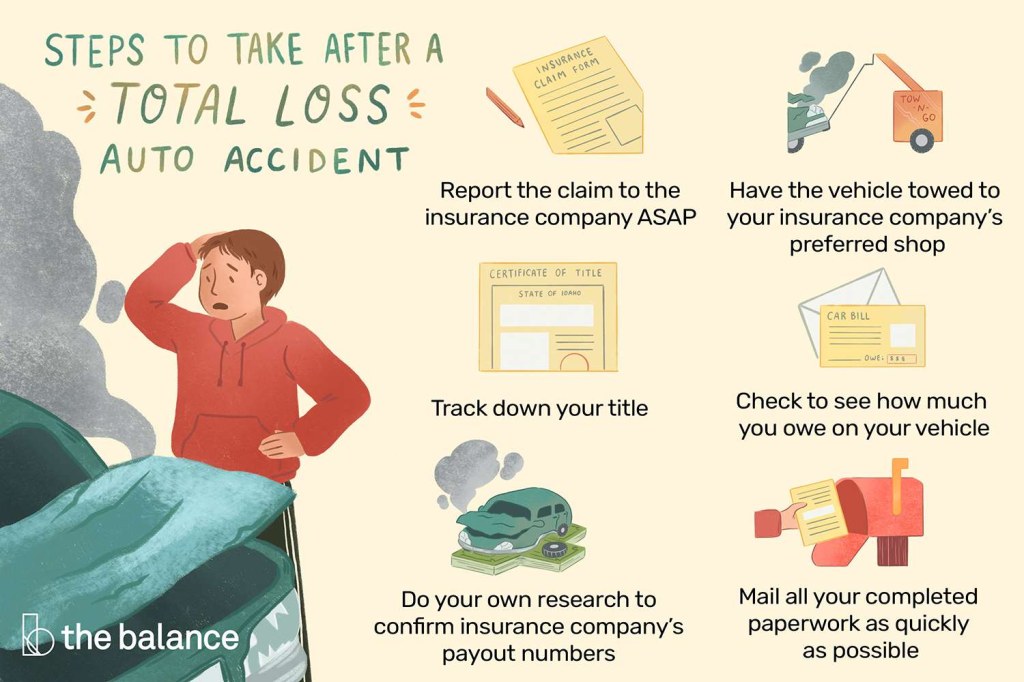

A loss of use car insurance claim can be made when your vehicle becomes unusable due to a covered event. Covered events can include accidents, theft, vandalism, or any other occurrence that renders your car temporarily out of commission.

The specific circumstances under which you can make a loss of use car insurance claim may vary depending on your insurance policy. It is important to review your policy documents to understand the events that are covered and the requirements for making a claim.

In general, you should make a loss of use car insurance claim as soon as your vehicle becomes unusable. Promptly notifying your insurance provider about the incident will ensure that the claims process is initiated in a timely manner, allowing you to receive the necessary compensation as quickly as possible.

Where Can You Make a Loss of Use Car Insurance Claim?

A loss of use car insurance claim can typically be made directly with your insurance provider. Most insurance companies have dedicated claims departments or helplines that you can contact to initiate the claims process.

When making a loss of use car insurance claim, it is important to provide your insurance provider with all the necessary information and documentation related to the incident. This may include police reports, accident reports, photographs, or any other evidence that supports your claim.

It is recommended to consult your insurance policy or contact your insurance provider directly to obtain specific instructions on how to make a loss of use car insurance claim. They will be able to guide you through the process and ensure that you fulfill all the requirements for a successful claim.

Why Should You Consider a Loss of Use Car Insurance Claim?

There are several reasons why you should consider a loss of use car insurance claim if you find yourself in a situation where your vehicle is temporarily unusable:

Continued Mobility: A loss of use car insurance claim allows you to maintain your mobility and continue your daily activities without disruptions. By providing compensation for rental car fees or alternative transportation costs, it ensures that you can still get to work, run errands, and fulfill your other obligations.

Financial Protection: Making a loss of use car insurance claim provides you with financial protection by covering the expenses you may incur while your vehicle is being repaired or replaced. Instead of having to bear the costs of renting a car or using alternative transportation out of your own pocket, the insurance claim ensures that you are reimbursed for these expenses.

Peace of Mind: Knowing that you have loss of use car insurance coverage can provide you with peace of mind, especially in situations where your car is not usable due to unforeseen circumstances. You can rest assured that you are protected and that you have the necessary support to overcome any temporary disruptions caused by car repairs or replacements.

How to Make a Loss of Use Car Insurance Claim?

Making a loss of use car insurance claim involves several steps to ensure a smooth and successful process:

Contact Your Insurance Provider: Notify your insurance provider as soon as your vehicle becomes unusable. Provide them with all the necessary information and documentation related to the incident, including police reports, accident reports, photographs, or any other evidence that supports your claim.

Follow the Claims Process: Your insurance provider will guide you through the claims process, providing you with specific instructions on the documentation you need to provide and the forms you need to fill out. Follow their instructions carefully to ensure that your claim is processed efficiently.

Cooperate with the Investigation: Your insurance provider may conduct an investigation to assess the validity of your claim. Cooperate fully with their investigation, providing any additional information or documentation they may require.

Review the Settlement Offer: Once the investigation is complete, your insurance provider will make a settlement offer based on their assessment. Review the offer carefully and consult with your insurance agent or legal counsel if necessary.

Accept or Appeal the Offer: If you are satisfied with the settlement offer, you can accept it and receive the compensation. If you believe the offer is insufficient, you can appeal the decision and negotiate for a higher settlement.

Keep Documentation: Throughout the claims process, it is important to keep copies of all documentation, including correspondence with your insurance provider, receipts for rental car fees or alternative transportation costs, and any other relevant paperwork.

Stay in Communication: Maintain regular communication with your insurance provider throughout the claims process to stay updated on the status of your claim and address any concerns or questions you may have.

Advantages and Disadvantages of Loss of Use Car Insurance Claim

Advantages:

Continued Mobility: Loss of use car insurance claim ensures that you can maintain your mobility and carry on with your daily activities without disruptions.

Financial Protection: This type of insurance claim covers the expenses of renting a car or using alternative transportation, providing you with financial protection during the period when your car is unavailable.

Peace of Mind: Knowing that you have loss of use car insurance coverage can give you peace of mind, as you are protected against the financial burden of temporary car unavailability.

Disadvantages:

Potential Limitations: Loss of use car insurance claim may have certain limitations and conditions that determine its coverage and eligibility. It is important to review your insurance policy to understand these limitations.

Out-of-Pocket Expenses: Depending on your policy terms, you may still have to bear some out-of-pocket expenses even when making a loss of use car insurance claim. This can include deductibles or certain types of rental car fees.

Potential Premium Increase: Filing a loss of use car insurance claim may result in a premium increase in future policy renewals. Consider the potential long-term financial impact before making a claim.

FAQs

Q: Does loss of use car insurance claim cover alternative transportation costs?

A: Yes, loss of use car insurance claim covers the expenses of using alternative transportation during the period when your car is unavailable.

Q: Do I need to have comprehensive car insurance to make a loss of use car insurance claim?

A: Yes, loss of use car insurance claim is typically included as part of comprehensive car insurance policies.

Q: How long does it take to process a loss of use car insurance claim?

A: The processing time for a loss of use car insurance claim may vary depending on the specific circumstances and the complexity of the claim. It is recommended to contact your insurance provider for an estimated timeline.

Q: Can I choose any rental car company when making a loss of use car insurance claim?

A: The selection of rental car companies may vary depending on your insurance policy. It is recommended to consult your insurance provider for a list of approved rental car companies.

Q: Can I make a loss of use car insurance claim if my car is stolen?

A: Yes, loss of use car insurance claim can be made if your car is stolen and unavailable for use. It covers the expenses of using alternative transportation during the period of unavailability.

Conclusion

In conclusion, loss of use car insurance claim is an essential coverage option for car owners. It provides financial protection and peace of mind by compensating for the expenses incurred while your car is being repaired or replaced. By understanding the eligibility requirements and the claims process, you can ensure that you make the most of this insurance coverage.

Whether it is an accident, theft, or any other event that renders your car temporarily unusable, loss of use car insurance claim allows you to maintain your mobility and continue with your daily activities without disruptions. It is a valuable coverage option that ensures you are not burdened with additional expenses during already challenging times.

If you are considering loss of use car insurance claim, we recommend reviewing your current insurance policy or consulting with your insurance provider. They will be able to guide you through the specifics of your coverage and provide you with the necessary information to make an informed decision.

Final Remarks

Loss of use car insurance claim is designed to provide financial support during periods when your car is not usable due to repairs or replacement. It is important to review your insurance policy and understand the terms, conditions, and limitations of this coverage.

Remember to consult with your insurance provider for personalized advice and guidance. They have the expertise to help you navigate the claims process and ensure that you receive the compensation you are entitled to.

Disclaimer: The information provided in this article is for informational purposes only and should not be considered as legal or financial advice. It is always recommended to consult with a professional insurance advisor or legal counsel for specific guidance regarding your insurance coverage.

This post topic: Used Car