Unveiling: Discover What Car Lenders Use TransUnion For Your Dream Ride!

What Car Lenders Use TransUnion

Welcome, readers! Today, we will delve into the topic of what car lenders use TransUnion. As you may know, TransUnion is one of the three major credit reporting agencies in the United States. It provides lenders with valuable information about individuals’ credit history, including their payment history, outstanding debts, and credit scores. In the context of car loans, TransUnion plays a crucial role in helping lenders assess the creditworthiness of loan applicants.

Introduction

In this article, we will explore the various aspects of what car lenders use TransUnion. We will discuss the significance of TransUnion in the lending industry, the benefits it offers to lenders and borrowers alike, and the potential drawbacks of relying on this credit reporting agency. Additionally, we will answer some frequently asked questions to provide you with a comprehensive understanding of the subject matter.

3 Picture Gallery: Unveiling: Discover What Car Lenders Use TransUnion For Your Dream Ride!

What Car Lenders Use TransUnion?

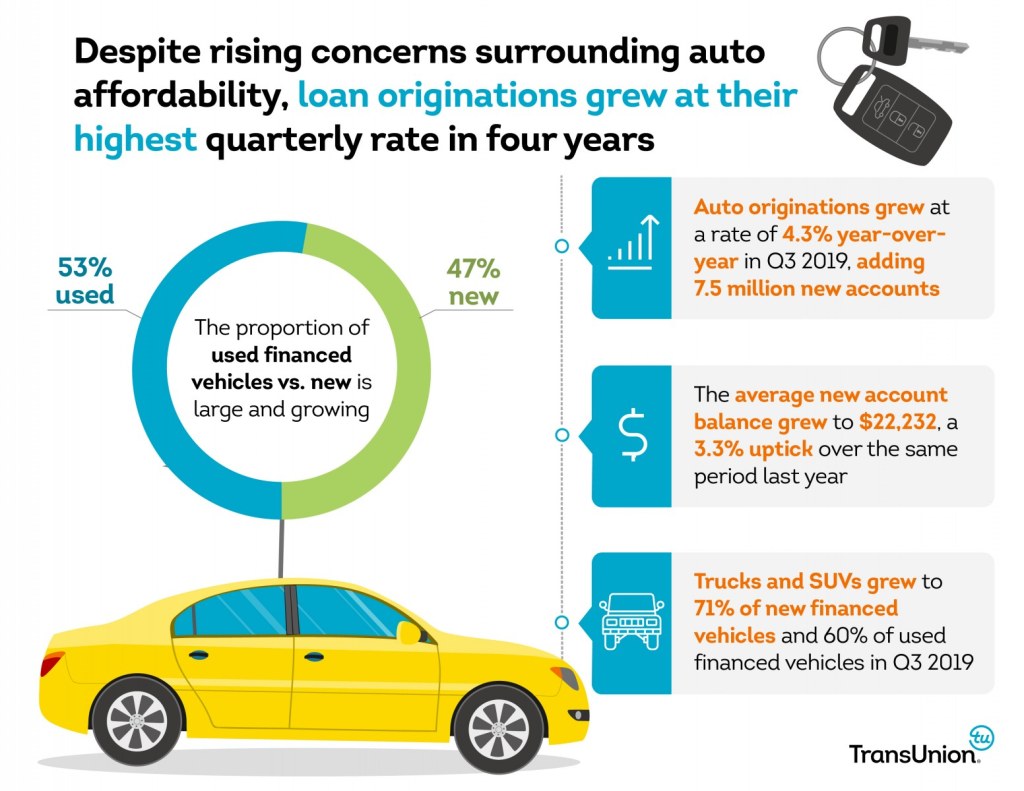

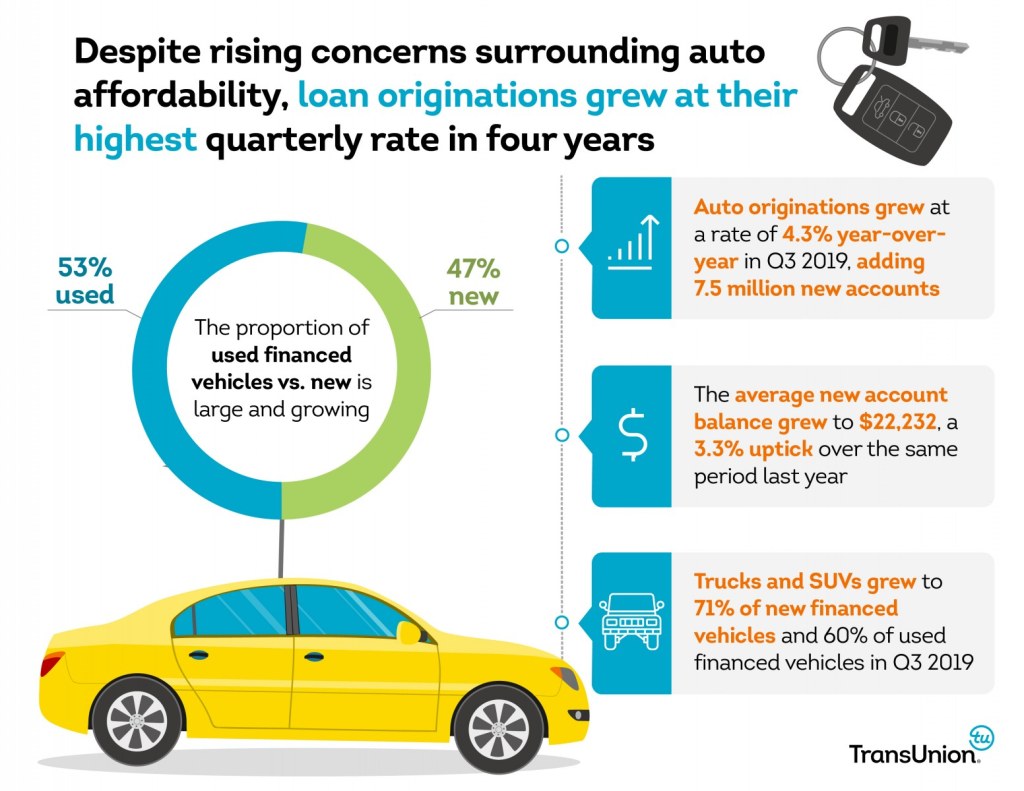

🚗 Car lenders, including banks, credit unions, and other financial institutions, utilize TransUnion’s credit reports and scores to assess the creditworthiness of loan applicants. These lenders rely on the information provided by TransUnion to make informed decisions regarding loan approvals, interest rates, and loan terms.

📋 TransUnion provides lenders with detailed credit reports that include individuals’ payment history, outstanding debts, and credit utilization. Additionally, TransUnion assigns a credit score to each individual, which serves as a numerical representation of their creditworthiness. This information helps lenders evaluate the level of risk associated with lending money to a particular individual.

Image Source: carmoola.co.uk

😃 By using TransUnion, car lenders can make more accurate lending decisions, offering competitive interest rates to borrowers with good credit scores while mitigating risks associated with lending to individuals with poor credit histories.

Who Uses TransUnion for Car Loans?

🏦 Various financial institutions rely on TransUnion’s services for their car lending operations. This includes traditional banks, credit unions, and online lenders. Additionally, auto finance companies and car dealerships also use TransUnion to assess the creditworthiness of potential car buyers.

🌐 TransUnion’s services are not limited to the United States alone. Lenders from around the world may utilize TransUnion’s data to evaluate the creditworthiness of individuals seeking car loans in their respective countries.

When Do Car Lenders Use TransUnion?

⌚ Car lenders typically use TransUnion’s services during the loan application process. When individuals apply for a car loan, lenders request their credit reports and scores from TransUnion to evaluate their creditworthiness. This information helps lenders determine the interest rates, loan terms, and loan amounts they are willing to offer to borrowers.

Image Source: presspage.com

🚀 It is important to note that car lenders may also periodically check an individual’s credit reports during the loan term to monitor their creditworthiness. This is especially true for loans with longer durations, such as auto loans that extend over several years.

Where Do Car Lenders Use TransUnion?

🌍 Car lenders across the United States and in various other countries use TransUnion’s services for their car lending operations. TransUnion operates on a global scale, providing credit reporting and scoring services to lenders and borrowers worldwide.

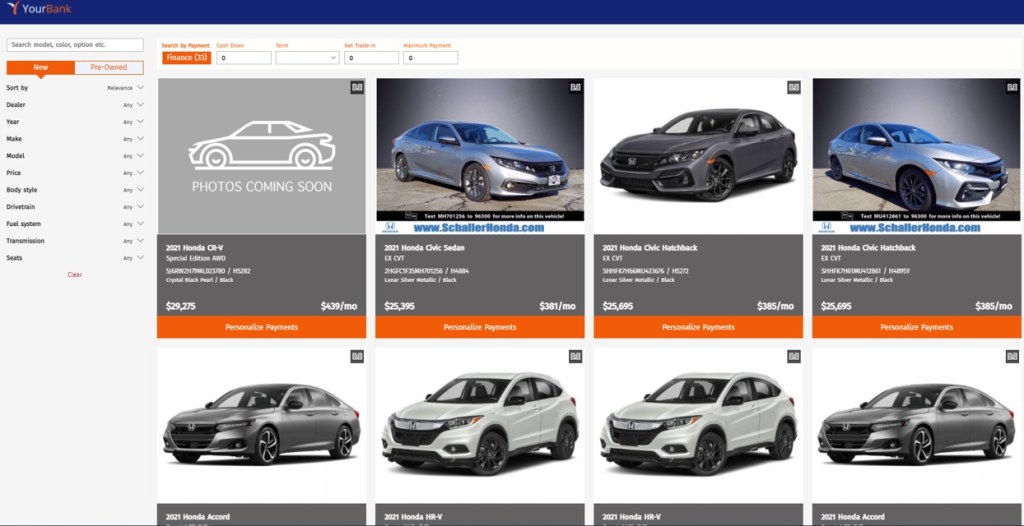

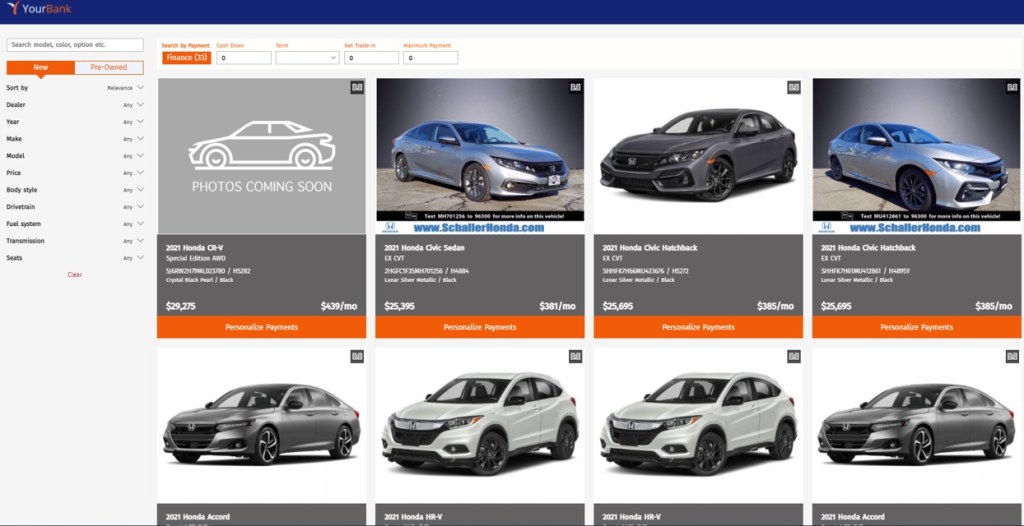

🏢 Lenders can access TransUnion’s data through its online platform or by integrating TransUnion’s services into their own loan origination systems. This allows lenders to conveniently access credit reports and scores when evaluating loan applications.

Why Do Car Lenders Use TransUnion?

✅ Car lenders use TransUnion for several reasons. Firstly, TransUnion provides comprehensive credit reports and scores that help lenders assess the creditworthiness of loan applicants. By considering an individual’s payment history, outstanding debts, and credit utilization, lenders can determine the level of risk associated with lending to that individual.

Image Source: autonews.com

✨ Additionally, TransUnion offers advanced analytics and risk assessment tools that enable lenders to make more informed lending decisions. These tools provide lenders with valuable insights into market trends, fraud detection, and risk management, helping them optimize their lending practices.

How Do Car Lenders Use TransUnion?

🔍 Car lenders use TransUnion by requesting credit reports and scores for loan applicants. Once they receive this information, lenders analyze it to determine the creditworthiness of the applicants. Factors such as payment history, outstanding debts, and credit scores are taken into consideration during the evaluation process.

📊 TransUnion’s advanced analytics and risk assessment tools assist lenders in making data-driven decisions. By leveraging these tools, lenders can identify potential risks and opportunities, enabling them to offer competitive loan terms to creditworthy individuals.

Advantages and Disadvantages of Using TransUnion for Car Loans

💪 Advantages:

Comprehensive credit reports provide lenders with detailed information about loan applicants’ credit history.

TransUnion’s credit scores help lenders assess the creditworthiness of loan applicants quickly.

Advanced analytics and risk assessment tools enable lenders to make informed lending decisions.

TransUnion operates globally, allowing lenders to assess the creditworthiness of individuals from various countries.

Using TransUnion helps lenders mitigate risks associated with lending to individuals with poor credit histories.

🤔 Disadvantages:

Reliance on credit reports and scores from a single credit reporting agency may not provide a complete picture of an individual’s creditworthiness.

TransUnion’s credit scores may differ from those of other credit reporting agencies, leading to inconsistencies in loan evaluations.

Errors or inaccuracies in TransUnion’s credit reports can negatively impact loan applicants’ chances of approval.

Some borrowers may have limited credit history, making it challenging for lenders to assess their creditworthiness accurately.

TransUnion’s services come at a cost to lenders, which may be passed on to borrowers in the form of higher interest rates or fees.

Frequently Asked Questions (FAQs)

1. Can car lenders use credit reports from other agencies instead of TransUnion?

Yes, car lenders have the option to use credit reports and scores from other credit reporting agencies, such as Equifax and Experian. However, TransUnion is one of the three major credit reporting agencies and is widely used by lenders across the United States.

2. Will checking my credit reports from TransUnion affect my credit score?

No, checking your own credit reports from TransUnion or any other credit reporting agency does not impact your credit score. This type of inquiry is known as a soft inquiry and is not visible to lenders.

3. How often should I check my credit reports from TransUnion?

It is recommended to check your credit reports from TransUnion at least once a year to review the information for accuracy. Additionally, you may want to check your reports before applying for a car loan or any other type of credit to ensure there are no errors or discrepancies.

4. Can I dispute errors on my TransUnion credit report?

Yes, if you find errors or inaccuracies on your TransUnion credit report, you have the right to dispute them. TransUnion provides a process for disputing errors online, allowing you to correct any misinformation and ensure the accuracy of your credit report.

5. How long does information stay on my TransUnion credit report?

The length of time that information remains on your TransUnion credit report varies. Generally, negative information such as late payments or accounts in collections can stay on your report for up to seven years. Positive information, such as on-time payments, can remain on your report for longer periods.

Conclusion

In conclusion, TransUnion plays a crucial role in the car lending industry. Car lenders rely on TransUnion’s credit reports and scores to assess the creditworthiness of loan applicants, enabling them to make informed lending decisions. While there are advantages to using TransUnion, such as comprehensive credit information and advanced analytics, there are also potential disadvantages, including reliance on a single credit reporting agency and the possibility of errors. It is important for both lenders and borrowers to understand the impact of TransUnion’s services on the car loan application process.

Final Remarks

Disclaimer: The information provided in this article is for informational purposes only and should not be considered financial or legal advice. It is always recommended to consult with a qualified professional before making any financial decisions or entering into any loan agreements.

This post topic: Used Car